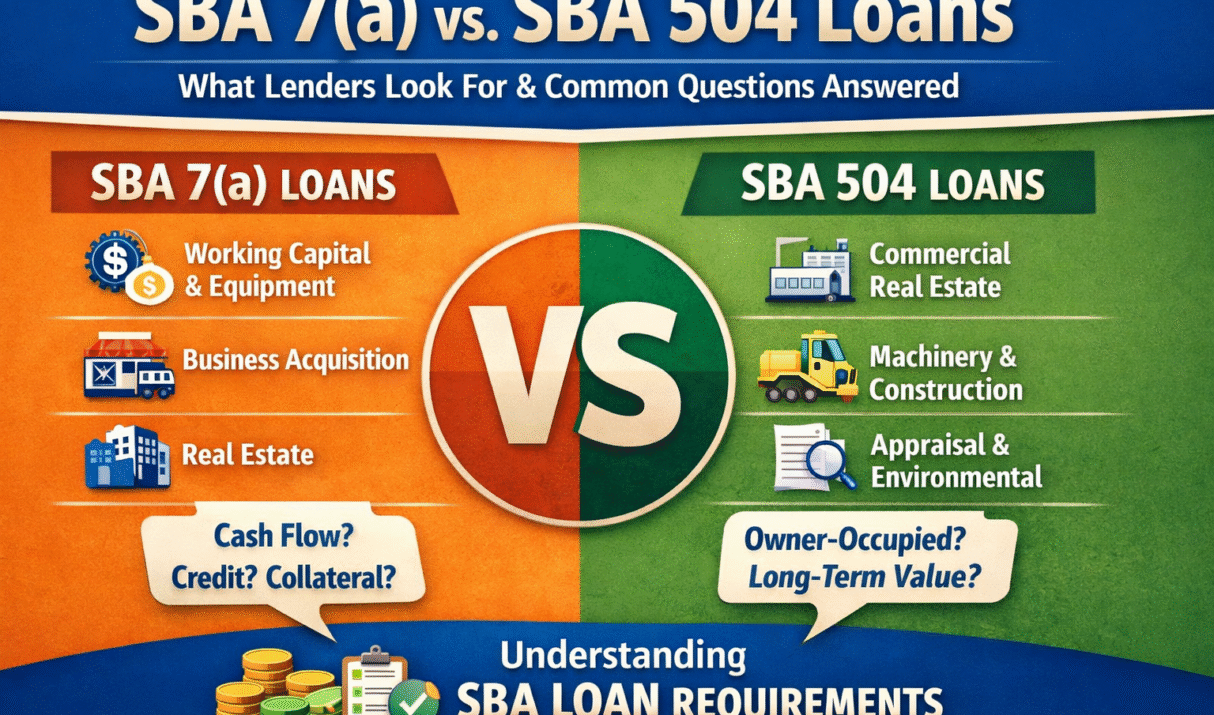

If you’re exploring SBA financing, two programs come up more than any others: SBA 7(a) and SBA 504 loans. While both are backed by the Small Business Administration, they serve very different purposes—and lenders evaluate them differently. Here’s a practical breakdown of how each program works, what lenders focus on, and the most common questions

When most people think about asset appraisals, they picture banks or big corporations. But the truth is—almost every industry relies on accurate equipment and asset valuations at some point. Whether a company is buying, selling, financing, insuring, or settling legal matters, a certified appraisal provides the clarity and documentation needed to make smart decisions. Here’s

The equipment appraisal process involves several key steps to determine the value of machinery and other tangible assets accurately. Here’s an overview of the typical process: 1. Identifying the Purpose of the Appraisal The appraiser first determines why the appraisal is needed (e.g., financing, sale, insurance, tax purposes, legal disputes). This affects the valuation approach

Equipment appraisals are needed by a variety of individuals and businesses across different industries. Some of the key groups that require equipment appraisals include: 1. Business Owners & Companies 2. Financial Institutions & Lenders 3. Insurance Companies 4. Legal & Accounting Professionals 5. Government Agencies 6. Investors & Private Buyers